NOTE: must courtesy ‘Foreign Policy Live.’

The IMF expects that global growth will slow in 2022, but remain positive despite lingering effects of pandemic and war in Ukraine the IMF’s Managing Director and First Deputy Managing Director announced in an event hosted by Foreign Policy Magazine Live today, Tuesday March 22nd.

The new projections will be released in April’s World Economic Outlook report during the IMF/WB Spring Meetings.

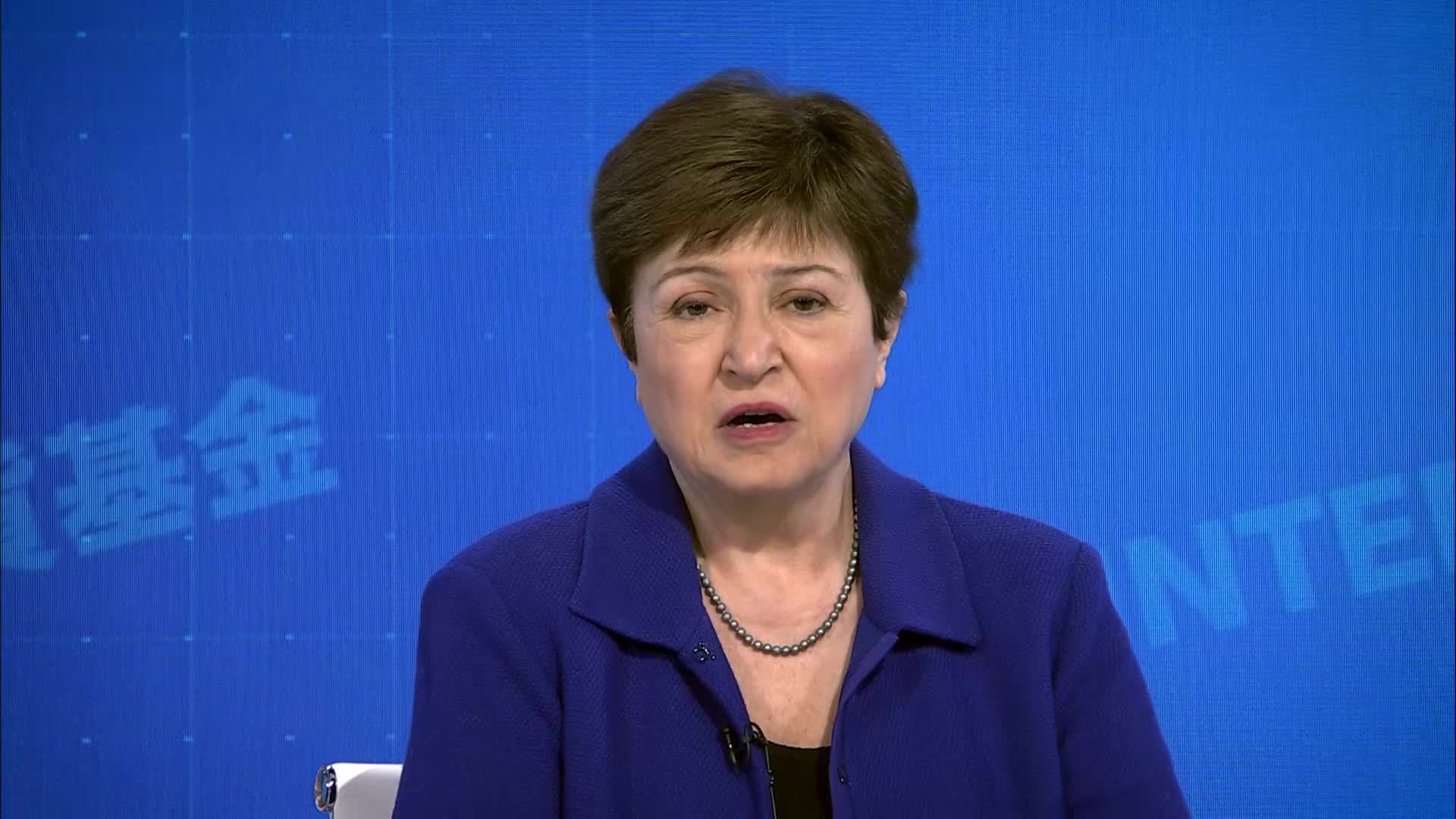

“We are likely to see shrinkage that could be a third of what it was before the war. Imagine how that translates into hardship on people. So, what we did was to immediately respond to a request from Ukraine for emergency financing, $1.4 billion. It is to keep the country functioning. It is to make sure that there is support for the most vulnerable people, that there is administration securing what I just talked about water and electricity, even in the war affected areas. We are also very closely engaged with Ukraine on how to apply best crisis management measures, so the economy does not collapse. And I would say that the money is important, but debt support on how to retain the functioning of the financial system is equally important,” said Kristalina Georgieva, IMF’s Managing Director.

Vis-à-vis the global economy, direct financial exposures to Russian sovereign debt are manageable, but ongoing events increase the probability of a risk-off episode that could pressure emerging markets.

“Russia has been current so far on its debt payments. It does have the dollars that are needed. It's earning those to be able to make those payments. Now we are still in the fog of war and there is uncertainty around the regulations and the ability to make the payment go through. So, there are risks associated with this, which is what we're seeing in terms of pricing of Russian debt on the market. In terms of what the impact would be if there were a default, I think the direct effect on the rest of the world would be quite limited because the numbers that we're looking at are relatively small from a global perspective, it is not a systemic risk to the global economy. However, you can of course have some banks that have greater exposure to these particular assets that could be negatively impacted. And of course, from Russia's perspective, it will have consequences for its long term. You know, when you've defaulted, reentry into the market is not that easy, and that can take a long time,” said Gita Gopinath, IMF’s First Deputy Managing Director.

Georgieva added that the desired scenario was for growth to go up and for inflation to go down. Instead, the exact opposite happened; growth is going down, and inflation is going up.

The IMF is assessing the impact of the war in Ukraine and the sanctions on Russia in different parts of the world in different categories of countries.

“The issue that is very concerning, of course, is the impact on inflation. It was hot before this crisis, it got hotter. And what does it mean? Of course, it means that there would be impact on real incomes of people, and that may have implications for demand. But it also means that central banks are going to be asked to step up their actions. And we are already seeing Chair Powel announcing that is coming, and rightly so. But for many emerging markets, tightening of financial conditions is going to be a big shock. And what I want to say today is that they have policy measures to respond, use them early. I'm particularly worried of low-income countries in debt distress,” said Georgieva.

On the pandemic’s impact on the global economy, Gopinath clarified that it is quite clear that COVID-19 is staying for the long term and there could be a mild endemic scenario. That's one possibility. On the other hand, there are very serious risks of much more serious downsides.

“On what was needed from the global community to address the health crisis, I believe they fell short. I think without a doubt they fell short. Progress was made. So, I can also put this in terms of a glass half full, which is that efforts were made. There was clearly pledges of vaccine donations. There was part financing of the ACT accelerator, there were part donations to COVAX, but not on the scale and not with the speed with which it was needed last year. Now we are in a situation where there is enough supply that has come through and countries are receiving sufficient supplies, including low-income countries. But there is now an absorption capacity issue and also a vaccine hesitancy issue. But given again how clear the economic benefits were to moving quickly, it is disappointing that not enough was done quickly enough and it's not too late to do the right thing because the pandemic is not over. If you just look at the chart of global cases on COVID over the last two weeks, they've been going up as cases have gone up in Europe and in Asia. So, we still have the opportunity to make - to do this right. It concerns me that when you look at budgets, the governments are thinking less about supporting the rest of the world,” said Gopinath.

To watch the full event, click here.